Saudi Arabia has reclaimed its position as the leading destination for startup financing in the Middle East and North Africa (MENA) region, driven mainly by fintech and later-stage activity.

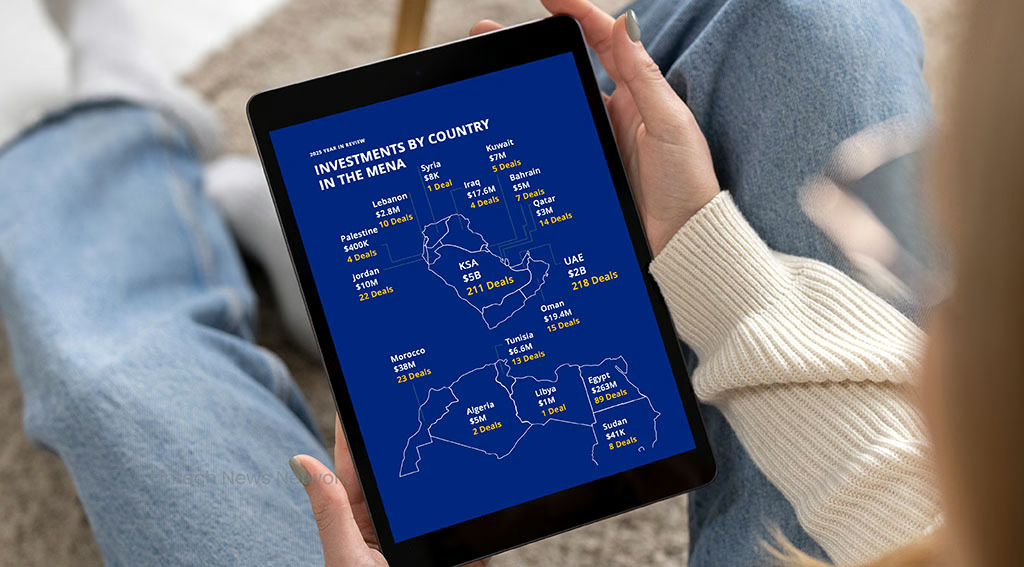

New data released by Wamda, a startup market research platform and venture capital (VC) investor, show that venture funding and debt financing to Saudi tech startups surged to US$5 billion in 2025. This represents a staggering 400% year-over-year (YoY) increase from just US$1 billion in 2024, and accounts for 67% of the region’s total startup funding, which reached US$7.5 billion in 2025.

The figure makes Saudi Arabia MENA’s top recipient of startup capital by a wide margin, well ahead of the second-ranked, the United Arab Emirates (UAE), which attracted US$2 billion, or 27% of the total. This underscores Saudi Arabia’s renewed appeal to investors.

Within this ecosystem, fintech was the main driver of startup financing activity. In Saudi Arabia, fintech startups secured a total of US$3.7 billion, capturing 74% of all startup financing in 2025. Across the broader MENA startup financing landscape, Saudi Arabia’s fintech industry accounted for nearly 50% of all tech investments in 2025, underscoring the sector’s position as the main driver of startup financing activity in the region.

Saudi fintech giants lead MENA startup financing activity

In 2025, startup financing activity in MENA was led by mega-deals going towards established Saudi fintech ventures. Tamara, Tabby, Hala, Lendo, and Erad, from Saudi Arabia, and CredibleX, from the UAE, secured six of the top ten deals of the year:

Tamara, a Saudi Arabia-based buy now, pay later (BNPL) specialist, secured a US$2.4 billion an asset-backed facility in September. This deal refinanced and expanded a prior US$500 million facility, with US$1.4 billion funded upfront and an additional US$1 billion available over three years, and aims to support Tamara’s vision to expand into new credit and payment products.

Tabby, another BNPL startup from Saudi Arabia, raised a US$160 million Series E in February, reaching a US$3.3 billion valuation. The company, which recently acquired Tweeq, a Saudi-based digital wallet, and expanded its product offering with a card product, a subscription program, long-term payment plans, and a buyer protection program, aims to further accelerate its financial services with digital spending accounts, payments, cards, and money management tools, among other products.

Hala, a Saudi embedded financial services provider, closed a US$157 million Series B in September. The company, which provides small and medium-sized enterprises (SMEs) with capabilities including business accounts, card issuance, point-of-sale (POS) solutions, and corporate cards, aims to expand its product offering, and enter new markets.

Lendo, a debt crowdfunding platform in Saudi Arabia, secured a total of US$740 million in financing in 2025. This comprises a US$690 million warehouse facility in January and a US$50 million Murabaha facility in September. The company, which connects qualified businesses seeking financing with investors seeking short-term returns, will use the proceeds to increase its lending capacity, introduce more innovative products, and expand its coverage of SMEs in Saudi Arabia.

Erad, a Saudi embedded finance platform, secured US$125 million in a credit deal in September. The company, which saw a strong six-fold year-over-year growth and over US$700 million in funding requests, will use the proceeds to grow its presence in Saudi Arabia, and expand into multiple sectors and products, including embedded finance products, enabling suppliers and business platforms to offer integrated financing at the point-of-sale (POS).

CredibleX, an UAE-based fintech platform, secured a US$100 million senior secured credit facility in September. The company, which provides SMEs with fast access to working capital through its digital application platform, will use the capital to fuel its growth, enabling easier access to quality financing options for SMEs in the region.

MENA tech financing rebounds

Tech investments in MENA experienced a significant rebound in 2025, surging 226% YoY. The surge in debt financing was the most notable, exceeding a 12-fold YoY increase and accounting for over half of the capital deployed in MENA in 2025.

Equity-led investments also demonstrated solid performance, recording a 75% YoY growth in value, and pointing to a broad-based expansion rather than a purely leverage-driven surge.

Investor interest remained at later-stages of growth, with 17 Series B rounds raising a combined US$636.8 million, Tabby’s Series E round, and a pre-IPO round for IMENA Group, a Saudi Arabia-based digital platform supporter, amounting to US$135 million.

Regional investors remained the most active participants, engaging in 413 transactions, equivalent to 64% of total deal count. Top investors included Sanabil 500, a partnership between Sanabil Investments from Saudi Arabia 500 Global from the US, Merak Capital from Saudi Arabia, both with 22 deals; Plus VC from the UAE with 17 deals; and Raed Ventures from Saudi Arabia with 12 deals.